HMA Agro Industries Ltd IPO Review- Buy or Not?

The stock market is buzzing with anticipation as HMA Agro Industries, a company specializing in the export of buffalo meat, prepares to make its debut on the stock market through an Initial Public Offering (IPO).

The IPO has garnered significant attention due to its unique nature, with HMA Agro Industries being the first company of its kind to be listed.

This article discusses about the details of HMA Agro Industries Limited, the company overview, its financial analysis, and complete IPO details and its review. In addition, we provide an analysis of the company’s financial position, as well as an examination of sentiment and concerns surrounding its business.

Understanding the IPO

The investor community has been abuzz with discussions about HMA Agro Industries’ IPO, primarily due to the company’s specialization in buffalo meat exports.

The potential monopoly in this niche market has caught the attention of investors, as HMA Agro Industries is one of India’s top three buffalo meat exporters.

However, the IPO has also faced opposition from vegetarians and those whose sentiments are hurt by the nature of the company’s business.

Company Overview

HMA Agro Industries derives 91% of its revenue from buffalo meat exports, making it the primary source of income.

Additionally, the company is involved in the frozen fish and basmati rice businesses, which contribute to the remaining 9% of its revenue. HMA Agro Industries emphasizes that it does not support the export of beef or cow meat, focusing solely on buffalo meat.

Despite these claims, some individuals remain skeptical about the company’s activities.

Financial Analysis

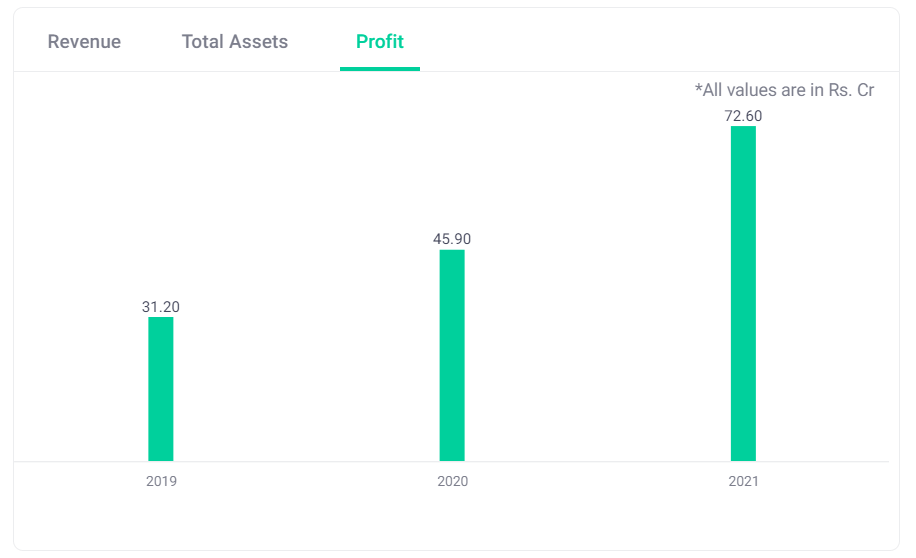

To gain a comprehensive understanding of HMA Agro Industries, it is crucial to examine its financial performance.

The company’s assets have shown consistent growth, increasing from 549 crores in 2019 to 856 crores in 2022.

While there is a continuous increase in debt, the company’s profit after tax has also seen a significant rise, reaching 117 crores in 2022 from 31 crores in 2019.

Factors to Consider

Although HMA Agro Industries boasts promising financials, certain aspects warrant consideration.

The company heavily relies on exports, making it vulnerable to changes in export regulations or the outbreak of diseases that could impact livestock. Furthermore, the company depends on third-party suppliers for its buffalo meat, adding another layer of potential risk.

HMA Agro Industries IPO Details

– HMA Agro Industries’ IPO is open for subscription from June 20 to June 23.

– HMA Agro Industries’ IPO is open for subscription from June 20 to June 23.

– The issue size is set at 480 crores, with a combination of offers for sale (330 crores) and fresh issues (150 crores).

– The share price range for the IPO is 555 to 585, requiring a minimum investment of 14,625 rupees.

– Retail investors can apply for up to 2 lakhs in this category. Refunds for non-allotted investors will be issued on June 30, while the shares will be credited to Demat accounts on June 3.

– Trading of HMA Agro Industries’ shares will commence on June 4.

Assessment and Recommendations

Considering the unique nature of HMA Agro Industries’ business and its growth potential, the IPO presents an interesting opportunity for investors.

However, individuals with personal or moral reservations regarding the meat industry may choose to abstain from investing.

Analyzing the subscription status and observing market sentiment before applying for the IPO is advisable.

Summary

As the first buffalo meat export company to go public, HMA Agro Industries’ IPO has generated significant interest in the stock market. By examining the company’s financial performance and evaluating potential risks, investors can make informed decisions regarding their participation in this IPO.

It is crucial to consider both financial aspects and personal values when assessing investment opportunities in the stock market.