Should I invest in US Stocks from India? Top 5 Reason

In today’s age, international investing has become a necessity rather than a choice. One of the prominent markets for investors is the US stock market. This article will explore the top 5 compelling reasons why investing in the US stock market, especially for individuals in India, is a wise decision.

Should I invest in US stocks from India?

Yes, investing in US stocks from India can be a beneficial decision. There are several compelling reasons to consider investing in the US stock market:

Top 5 Reasons to Invest in US Stocks from India

1. Diversification: Expanding Horizons

Diversification is a key principle in investing, and the US stock market offers an excellent opportunity to diversify your investment portfolio.

While asset-based, time-based, and industry-based diversification is commonly pursued, geography-based diversification often gets overlooked. By investing in the US stock market, you can mitigate the risks associated with being solely exposed to a single country or currency.

This geographical diversification ensures a more balanced and resilient investment approach.

2. The Global Market Leader

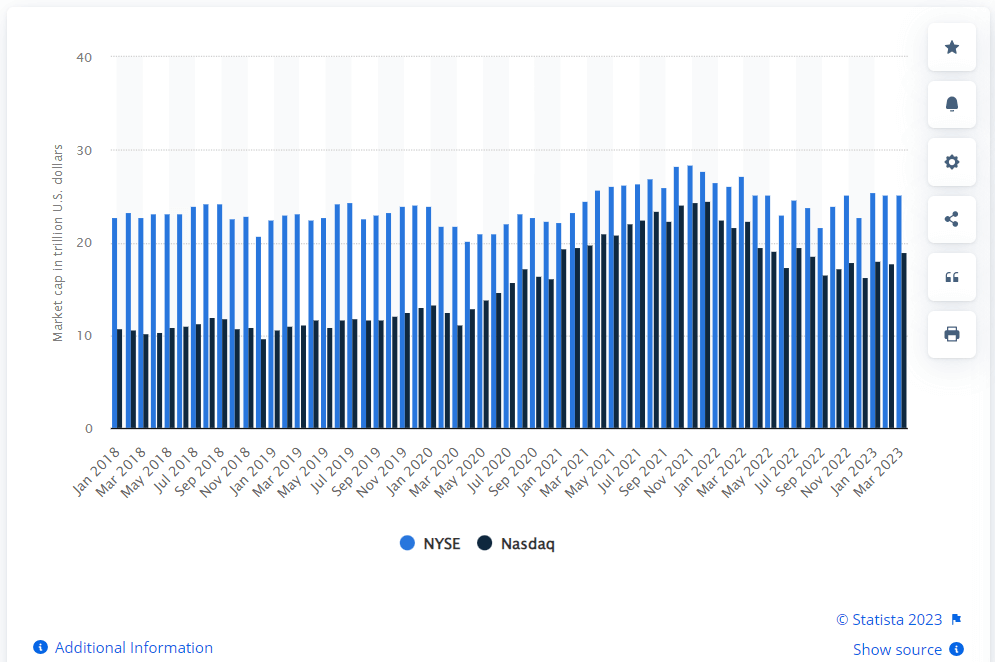

The US stock market holds a dominant position as the largest stock market worldwide. With over 56% of the global market capitalization, it offers a vast array of investment options.

The New York Stock Exchange (NYSE) and Nasdaq, together, boast a staggering $42 trillion in market capitalization.

Such a massive market provides investors with ample liquidity and numerous investment opportunities.

3. Superior Returns: A Decade of Outperformance

When comparing the performance of the US stock market to the Indian market over the past decade, the US market has consistently outperformed. Suppose we consider an investment of INR 10,000 in both the Indian benchmark index Sensex and the US benchmark index S&P 500 ten years ago.

The INR 10,000 invested in the Sensex would have grown to approximately INR 28,000, whereas the same investment in the S&P 500 would have reached INR 37,000. While the difference may not appear significant at first, it’s crucial to consider the currency factor.

The depreciation of the Indian rupee by 63% against the US dollar in the last ten years makes a considerable impact. When comparing the investments in the same currency, INR 10,000 in the Sensex would be worth only INR 17,000, while the investment in the S&P 500 retains its value.

4. Access to Global Brands and Emerging Sectors

The US stock market offers investors access to globally recognized brands such as Apple, Facebook, Google, Nike, Starbucks, and more.

However, it doesn’t stop there. Investors can also tap into companies at the forefront of cutting-edge industries that are poised for significant growth in the coming years. Sectors like Artificial Intelligence, CRISPR in healthcare, cloud computing, and electric vehicles provide excellent investment opportunities.

The US public markets allow investors to participate in these promising sectors and benefit from their potential growth.

5. Currency Alignment for Global Aspirations

Many individuals have global ambitions, whether it’s studying abroad, living overseas, or traveling extensively.

By investing in the US stock market, you align your savings with the same currency, thereby reducing the currency risk associated with your aspirations.

This alignment ensures that fluctuations in exchange rates do not negatively impact your financial goals.

These were the top 5 reasons Why any individual or businessman should invest in US stock exchanges. Let’s make sure we’re clear:)

Summary

Investing in the US stock market from India offers several compelling advantages.

The diversification it provides, coupled with its status as the world’s largest stock market, makes it an attractive destination for investors. Its history of outperforming the Indian market, access to global brands and emerging sectors, and the ability to align with one’s global aspirations by saving in the same currency further solidify its appeal.

As always, it is essential to conduct thorough research, seek professional advice, and make informed investment decisions based on individual financial goals and risk tolerance.

FAQs:

- Should I invest in US Stocks from India?

Yes, investing in US stocks from India can be a beneficial decision. There are several compelling Benefits to consider investing in the US stock market:

- Why should I invest in US stocks from India?

Investing in US stocks from India can be a beneficial decision for several reasons. The top 5 reasons are

- Diversification: Expanding Horizons

- The Global Market Leader

- Superior Returns: A Decade of Outperformance

- Access to Global Brands and Emerging Sectors

- Currency Alignment for Global Aspirations