Best Approach to Invest in International Mutual Funds

Investing in international mutual funds can be a complex endeavor, often leaving investors with unanswered questions. While India-specific mutual funds provide a clearer understanding of the investment structure, expense ratios, and portfolio composition, international funds may seem like a black box.

In this article, we will delve into the world of international mutual funds, providing an analysis of their structure, expense ratios, investment styles, and the best approach for investing in these funds.

Understanding International Equity Funds

The Securities and Exchange Board of India (SEBI) defines international equity funds as schemes where over 80% of the assets are invested in equities or equity-linked assets of foreign countries.

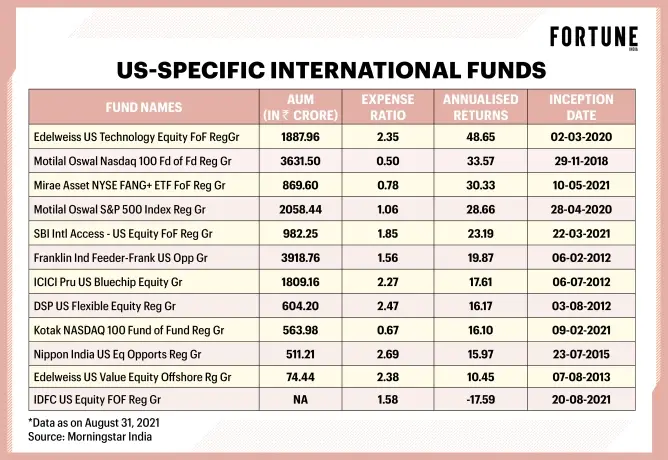

Currently, 44 different international funds are managing over 15,000 crores in assets. However, the broadness of the 80% asset allocation requirement necessitates a better understanding of this category. Our researchers have examined each of the 44 schemes, categorizing them into workable segments.

Structure of International Funds

While mutual fund companies typically manage their funds internally, the management of international funds often involves outsourcing.

Among the 44 international funds, only 7 are managed internally by Indian asset management companies (AMCs).

The remaining 37 funds follow a fund-of-funds (FoF) structure, wherein an Indian mutual fund invests in other mutual fund schemes.

For example, the SBI International Access U.S. Equity Fund invests in the Amundi U.S. Pioneer Fund, which, in turn, invests in companies worldwide. Other AMCs, such as DSP, Edelweiss, Access, and Aditya Birla AMC, also adopt the FoF structure.

Additionally, some AMCs like Motilal Oswal and Sundaram operate their international funds domiciled overseas. These variations in fund structure offer advantages such as access to investment professionals with expertise in foreign markets.

Expense Structure of FoF Schemes

It is essential to examine the expense structure of FoF schemes.

As per the SEBI circular of September 2018, FoFs that invest in actively managed equity funds can charge up to 2.25% as the total expense ratio, which includes the underlying fund expenses. The direct plans of international mutual fund schemes would have a maximum expense ratio of around 1.5% to 1.6%.

However, the reporting practices of expense ratios vary among fund houses, leading to confusion for investors. Some report expense ratios are inclusive of underlying scheme expenses, while others report them independently.

To address this confusion, our research team has created a comprehensive worksheet providing a list of international funds, their expense ratios, and insights on investing style and portfolio composition.

Geographical Choices and Investing Styles

International mutual funds offer various options based on geographical preferences. Investors can choose funds specific to countries such as Japan, China, ASEAN countries, Europe, Brazil, or the United States.

Alternatively, they can opt for global funds that invest worldwide. The most popular benchmarks for all-country funds are the MSCI World Index, MSCI All Country World Index, and S&P Global Index.

Understanding the valuation tools used globally, such as the price-to-earnings (P/E) ratio, can aid in evaluating international funds’ performance against these benchmarks.

Considerations for Investing Styles

Investing styles in international funds can be categorized based on four considerations:

- Theme or sector: While some international funds are diversified and invest across various sectors, others focus on specific industries such as agriculture, energy, technology, real estate, or consumer trends. Understanding the portfolio composition is crucial, as fund names might not always reflect their actual holdings.

- Growth, value, or blended: International funds can follow different investment styles, including growth, value, or a combination of both (blended). Growth funds typically invest in companies expected to experience above-average growth rates, while value funds focus on companies believed to be undervalued by the market. Blended funds seek a balance between growth and value strategies. It’s important to align your investment goals and risk tolerance with the fund’s investment style.

- Large-cap, mid-cap, or small-cap: International funds can also be classified based on the market capitalization of the companies they invest in. Large-cap funds invest in well-established, large companies, mid-cap funds focus on medium-sized companies, and small-cap funds target smaller companies with higher growth potential. Each category carries risk and return characteristics, so consider your risk appetite when selecting a fund.

- Active or passive: International funds can be actively managed, where fund managers actively make investment decisions, or passively managed, where the fund aims to replicate the performance of a specific index. Active management comes with the potential for outperformance but also higher fees, while passive funds generally have lower prices but aim to match the performance of the chosen index. Consider your preference for active or passive management when selecting a fund.

Best Approach for Investing in International Mutual Funds

Here are some key considerations for investing in international mutual funds:

- Understand your investment goals: Clearly define your investment objectives, whether it’s diversification, capital appreciation, income generation, or a combination of these. This will help you align your investment strategy with suitable international funds.

- Do thorough research: Take the time to research and analyze different international funds. Consider their historical performance, expense ratios, investment styles, portfolio composition, fund managers’ expertise, and risk factors. Pay attention to any regulatory or geopolitical risks that may affect the countries or regions the funds invest in.

- Diversify across regions and sectors: International funds can provide exposure to different countries, economies, and sectors. Diversifying your investments across regions and sectors can help mitigate risks associated with specific countries or industries. Consider allocating your investments across funds with different geographical focuses and sector allocations.

- Assess fund managers’ expertise: For actively managed international funds, evaluate the fund managers’ experience, track record, and investment philosophy. Look for consistency in performance and their ability to navigate different market conditions. Consider funds managed by experienced professionals with a strong understanding of global markets.

- Consider the currency risk: Investing in international funds involves exposure to foreign currencies. Fluctuations in exchange rates can impact the fund’s returns when converted back to the investor’s domestic currency. Assess the fund’s approach to managing currency risk and consider hedged or unhedged options based on your risk tolerance.

- Regularly review your investments: Periodically review your international fund investments to ensure they continue to align with your investment goals and risk tolerance. Stay updated on market trends, geopolitical developments, and changes in fund-specific factors that may impact the performance of your investments.

- Consult with a financial advisor: If you’re uncertain about investing in international mutual funds or need personalized advice, consider consulting with a qualified financial advisor. They can provide guidance based on your specific financial situation, risk profile, and investment objectives.

Disclaimer: Remember that investing in international mutual funds carries risks, including market volatility, currency fluctuations, geopolitical events, and country. This post is for educational purposes only, not an endorsement. it is just a piece of advice that you must have to know before Investing in International Mutual Funds. thanks for reading…